Did You Know That If You Are Having Renovations Or Improvements Carried Out On Your Home Without Telling Your Insurer It May Invalidate Your Policy?

By Crowthorne Insurance on Jan 15, 2020 12:00:00 AM

Generally speaking, most household insurers will need to know if you are having any building works carried out to your property. Dependant on the type of work being done and the costs involved your insurer may impose special terms, restrict cover or even refuse to cover the property whilst the work is being carried out.

What Type Of Building Work Will Insurers Need To Know About?

Whilst most insurers realise that general maintenance and redecorating of your home will be required, they will want to know if any work involving builders or tradesmen will be taking place. This can range from having a conservatory fitted, loft conversions, driveway replacement through to a building extension. If in doubt, you should contact your insurer or broker BEFORE any work starts.

What Sort Of Restrictions Might My Insurer Impose?

It depends on what type of renovation is being carried out, the cost involved and the length of time the work is being done. Some insurers may be happy to continue with full cover; others may restrict certain cover such as excluding accidental damage, theft and water damage, and some may refuse to offer any cover which would potentially leave you uninsured.

Will My Builder’s Insurance Cover My Home?

Any reputable builder should have liability insurance and contract works. This will normally cover the builder if they damage your property and also cover the work they are doing. However, it will not cover the rest of your home – your own home insurance is still required.

What If My Home Insurer Will Not Cover Me?

If your home insurer will not cover you, or are imposing terms which you find are unacceptable, there are specialist schemes available. Dependant on what the works are, these will determine what cover can be provided. The period of cover can normally be issued for 3, 6 or 12 months.

If you need cover for your home for any renovations that are due to be carried out then contact Crowthorne Insurance for more details and a no obligation quote.

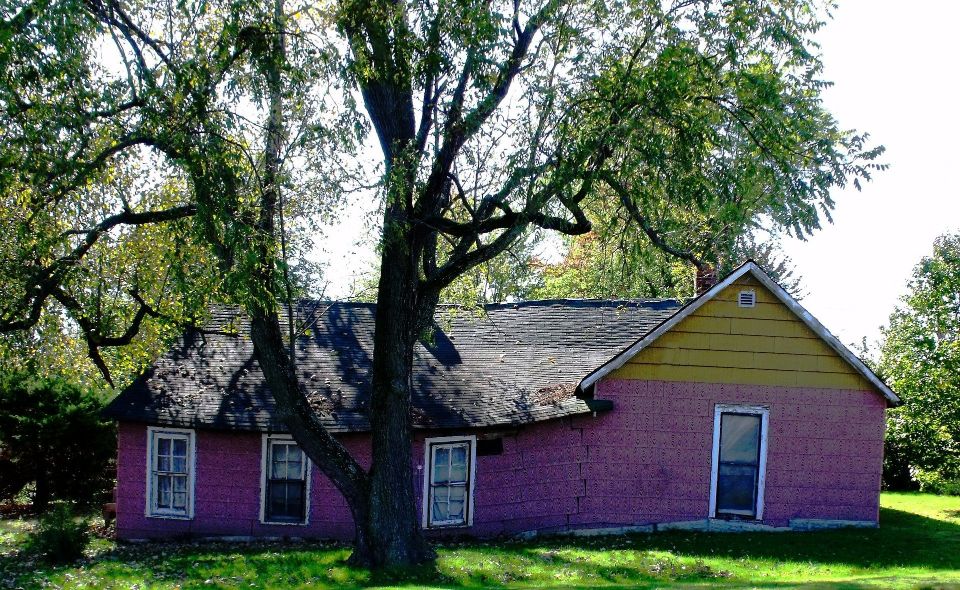

Image source: Pixabay

- Home Insurance (30)

- Motor Trade Insurance (18)

- Non-Standard Homes (17)

- Car Insurance (12)

- Subsidence (10)

- Motor Trade Policy (3)

- Bad Credit History (2)

- Business Insurance (2)

- Insurance Broker UK (2)

- Motorcycle Insurance (2)

- Public Liability Insurance (2)

- Travel Insurance (2)

- Additional Business Use (1)

- Car Accident (1)

- Case Study (1)

- Holiday Home Insurance (1)

- Motor Insurance Database (1)

- Service Indemnity Insurance (1)

- Timber Frame House (1)

- February 2026 (3)

- January 2026 (8)

- December 2025 (7)

- November 2025 (4)

- October 2025 (4)

- September 2025 (3)

- August 2025 (1)

- April 2025 (1)

- March 2025 (1)

- November 2024 (1)

- October 2024 (2)

- September 2024 (1)

- July 2023 (1)

- June 2023 (1)

- June 2022 (1)

- March 2022 (2)

- February 2022 (2)

- January 2022 (2)

- September 2021 (1)

- August 2021 (5)

- July 2021 (2)

- June 2021 (2)

- May 2021 (2)

- March 2021 (2)

- February 2021 (2)

- January 2021 (2)

- December 2020 (2)

- November 2020 (1)

- October 2020 (3)

- September 2020 (2)

- August 2020 (2)

- July 2020 (2)

- June 2020 (1)

- May 2020 (2)

- April 2020 (3)

- March 2020 (2)

- February 2020 (2)

- January 2020 (5)

- December 2019 (3)

- November 2019 (3)

- October 2019 (1)

- September 2019 (4)

- August 2019 (4)

- July 2019 (7)

- June 2019 (4)

- April 2019 (3)

- March 2019 (3)

- February 2019 (1)

- June 2010 (1)

Subscribe by email

You May Also Like

These Related Stories

How To Protect Your Home During Renovations and Construction

Understanding Homeowner Insurance Deductibles If Your Property Has Been Damaged

No Comments Yet

Let us know what you think