Are Timber Frame Houses More Expensive To Insure?

By Crowthorne Insurance on Dec 16, 2025 10:00:00 AM

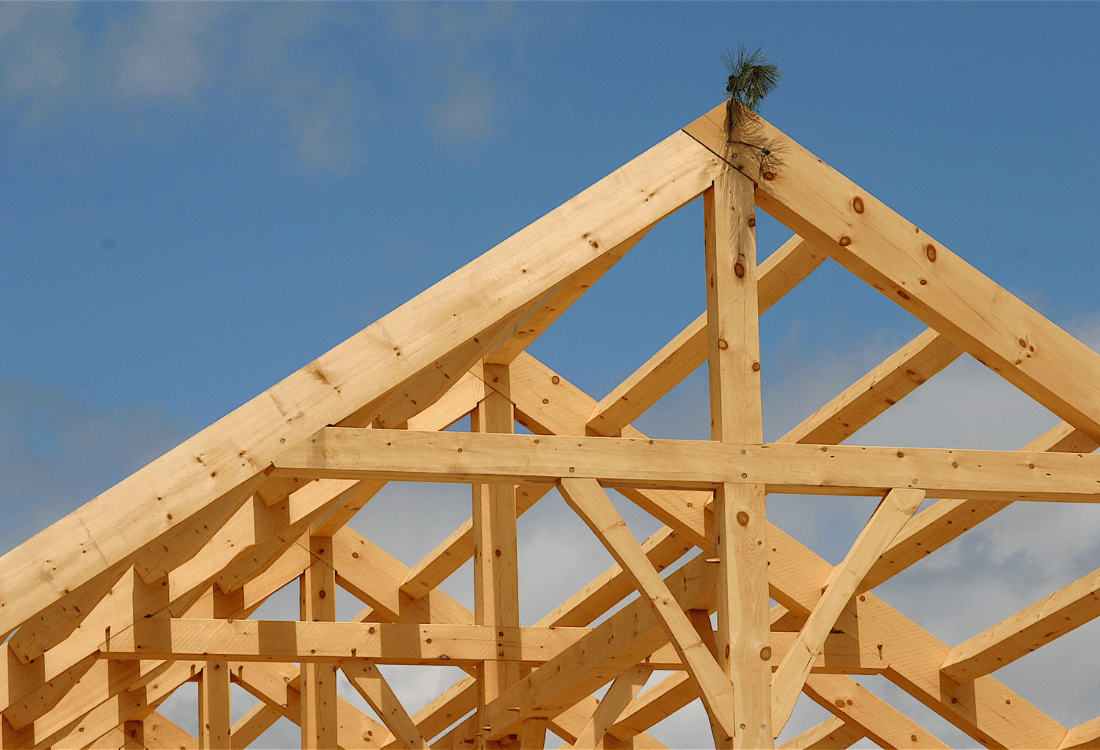

Timber frame homes have become increasingly popular in the UK thanks to their sustainability, energy efficiency, and aesthetic potential when left visible. Yet homeowners are often surprised to find that insuring these properties can be more complicated than they expected. The reason lies in how insurers classify the construction.

This short guide explains why insurance for timber-framed houses is often considered non-standard, why premiums may be higher, and how to find the right cover at a fair price.

Why Timber Frame Houses Are Classed As Non-Standard Construction

Most UK home insurance policies are based on properties built from brick or stone with tile or slate roofs. Anything that differs from this, including timber frame, is classed as “non-standard construction.”

Timber structures perform differently under certain conditions, particularly when exposed to heat or moisture. While modern timber frames are designed to meet today's safety standards, insurers often view them as a higher risk for fire and water damage.

This can make finding cover more difficult and may result in higher premiums.

Are Timber Frame Houses More Expensive To Insure?

In many cases, yes. Timber-framed house insurance can cost more than standard home insurance, though the difference depends on several factors.

Insurers price policies based on perceived risk and rebuild cost, and timber properties can increase both of these metrics.

The main considerations include:

- Fire risk: Timber is flammable, so insurers may rate it as more vulnerable to fire than brick or stone.

- Water damage: Timber can be more susceptible to rot or swelling if moisture enters the frame.

- Rebuild cost: Specialist contractors and materials are often required for repairs, which can increase claims costs.

- Age and design: Modern engineered timber is generally more resilient than older frames, but insurers will still ask about construction type, maintenance, and any fire prevention measures.

None of this means timber homes are uninsurable. It just highlights why insurance comparison sites often fall short for owners of timber frame homes.

Why Comparison Sites Are Not The Best Option

Comparison websites are designed for standard properties. Many don't differentiate between timber and brick construction or offer the option to declare non-standard materials accurately. What's more, selecting the wrong description on a price comparison site could lead to an invalid policy or rejected claims.

Homeowners who rely solely on automated comparison quotes may find their chosen insurer later declines cover once the true construction gets disclosed. A tailored quote from a specialist broker ensures the property is assessed correctly and that cover terms are appropriate for the materials and rebuild costs involved.

How To Find The Right Insurance For Timber Framed Houses

To obtain the best insurance for timber-framed houses, homeowners should:

- Provide full construction details, including the type of frame and wall cladding.

- Confirm fire protection features such as alarms and suppression systems.

- Keep maintenance records to demonstrate responsible ownership.

- Work with a broker who understands non-standard construction and has access to specialist insurers.

Get Specialist Timber Framed House Insurance With Crowthorne

Owning a timber frame home shouldn't mean overpaying for protection. At Crowthorne Insurance, we arrange competitive, reliable timber-framed house insurance policies designed to reflect the property’s true risk profile. As members of the British Insurance Brokers’ Association (BIBA), we provide expert, impartial advice with access to leading specialist insurers.

Avoid the frustration of comparison sites. Contact Crowthorne today for expert guidance and a personalised quote on insurance for timber-framed houses.

Image Source: Canva

- Home Insurance (30)

- Non-Standard Homes (17)

- Motor Trade Insurance (16)

- Car Insurance (12)

- Subsidence (10)

- Bad Credit History (2)

- Business Insurance (2)

- Insurance Broker UK (2)

- Motor Trade Policy (2)

- Motorcycle Insurance (2)

- Public Liability Insurance (2)

- Travel Insurance (2)

- Additional Business Use (1)

- Car Accident (1)

- Case Study (1)

- Holiday Home Insurance (1)

- Motor Insurance Database (1)

- Service Indemnity Insurance (1)

- Timber Frame House (1)

- January 2026 (8)

- December 2025 (7)

- November 2025 (4)

- October 2025 (4)

- September 2025 (3)

- August 2025 (1)

- April 2025 (1)

- March 2025 (1)

- November 2024 (1)

- October 2024 (2)

- September 2024 (1)

- July 2023 (1)

- June 2023 (1)

- June 2022 (1)

- March 2022 (2)

- February 2022 (2)

- January 2022 (2)

- September 2021 (1)

- August 2021 (5)

- July 2021 (2)

- June 2021 (2)

- May 2021 (2)

- March 2021 (2)

- February 2021 (2)

- January 2021 (2)

- December 2020 (2)

- November 2020 (1)

- October 2020 (3)

- September 2020 (2)

- August 2020 (2)

- July 2020 (2)

- June 2020 (1)

- May 2020 (2)

- April 2020 (3)

- March 2020 (2)

- February 2020 (2)

- January 2020 (5)

- December 2019 (3)

- November 2019 (3)

- October 2019 (1)

- September 2019 (4)

- August 2019 (4)

- July 2019 (7)

- June 2019 (4)

- April 2019 (3)

- March 2019 (3)

- February 2019 (1)

- June 2010 (1)

Subscribe by email

You May Also Like

These Related Stories

Non-Standard Vs Standard Homes: Know The Difference

Is Your Property Non-Standard? Insurance Impacts Explained

No Comments Yet

Let us know what you think