A History Of Subsidence? What To Know About Subsidence Home Insurance

By Crowthorne Insurance on Jan 22, 2026 10:00:01 AM

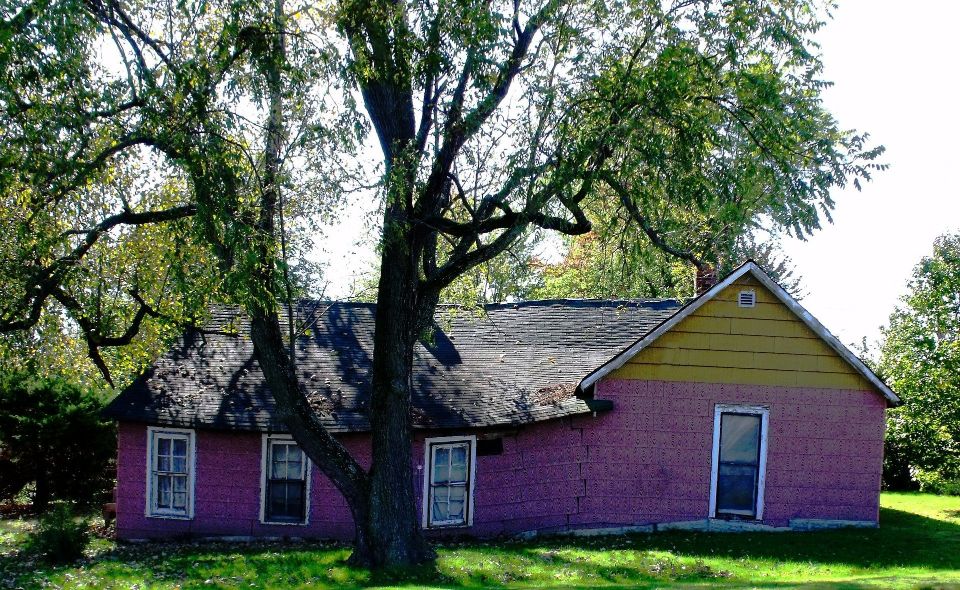

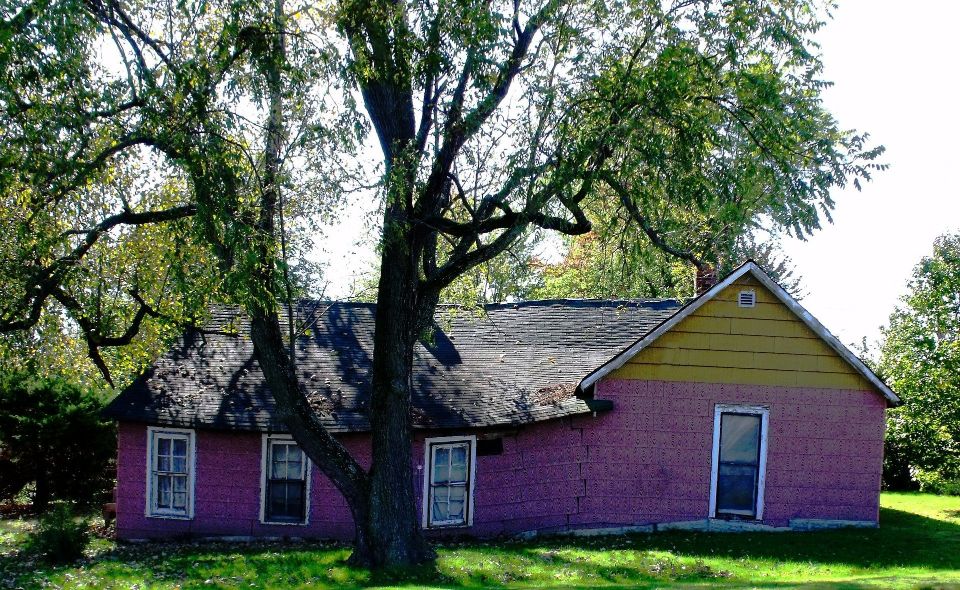

Buying a home is one of the biggest investments most people will ever make. Discovering a history of subsidence can therefore be very worrying. The very word itself can even raise alarm bells, but a history of subsidence doesn’t have to be a dealbreaker. With the right checks and the right policy, a home insurance with subsidence can protect your property and your investment.

This guide explains what subsidence means, how it affects your home insurance, and how to find suitable cover if you’re buying or living in a property that has experienced it.

What Is Subsidence?

Subsidence occurs when the ground beneath a building sinks or shifts, causing the property’s foundations to move. This movement can lead to cracks in walls, uneven floors, or sticking doors and windows.

Common causes include tree roots drawing moisture from clay soil, leaking drains, or changes in groundwater levels. Once identified, it’s important to determine whether the issue is active (still moving) or historical (stabilised after repairs).

Historical Vs Active Subsidence

If subsidence has been resolved, a property can still be safe and insurable. Insurers will, however, want evidence that the problem was professionally repaired and has remained stable for several years. A full structural survey is essential before a purchase to confirm this.

Active subsidence, however, is a different matter. Ongoing movement means insurers will treat the property as high risk, and standard cover is likely to be declined. In these cases, specialist subsidence home insurance in the UK is needed.

How Subsidence Affects Home Insurance

Buildings insurance policies usually include subsidence insurance as standard, but crucially, this only applies to properties that have never experienced subsidence before.

Properties with a history of subsidence are generally more expensive to insure because the risk of future movement remains higher than average. Many standard insurers exclude such properties altogether, so premiums may increase, and policy terms may be more limited.

When applying for home insurance with a subsidence history, insurers will typically ask for:

-

A detailed structural survey or an engineer’s report

-

Records of underpinning or other repairs

-

Evidence of stability over time

Failing to declare known subsidence could invalidate your policy, so transparency is absolutely vital.

Finding Specialist Home Insurance With Subsidence

If you’re struggling to find cover, there are specialist insurers who focus on non-standard properties, including those with a history of subsidence. These policies are tailored to your property’s condition and may include conditions such as regular inspections or higher excesses for future claims.

Working with an experienced broker can make all the difference, as brokers have access to insurers who understand the nuances of subsidence risk and can negotiate fair terms that reflect your property’s true condition rather than its past issues.

Protect Your Property With Confidence

A history of subsidence doesn’t have to prevent you from owning or insuring your dream home. With the right advice and cover, you can protect your property, satisfy your mortgage lender’s requirements, and buy with confidence.

At Crowthorne Insurance, we help homeowners secure the right home insurance with subsidence. As members of the British Insurance Brokers’ Association (BIBA), we work with trusted UK insurers who provide specialist solutions for properties with previous movement. Safeguard your investment today and contact Crowthorne for expert advice and a tailored quote on subsidence home insurance in the UK.

Image Source: Canva- Home Insurance (29)

- Non-Standard Homes (17)

- Motor Trade Insurance (15)

- Car Insurance (12)

- Subsidence (9)

- Bad Credit History (2)

- Business Insurance (2)

- Insurance Broker UK (2)

- Motor Trade Policy (2)

- Motorcycle Insurance (2)

- Public Liability Insurance (2)

- Travel Insurance (2)

- Additional Business Use (1)

- Car Accident (1)

- Case Study (1)

- Holiday Home Insurance (1)

- Motor Insurance Database (1)

- Service Indemnity Insurance (1)

- Timber Frame House (1)

- January 2026 (6)

- December 2025 (7)

- November 2025 (4)

- October 2025 (4)

- September 2025 (3)

- August 2025 (1)

- April 2025 (1)

- March 2025 (1)

- November 2024 (1)

- October 2024 (2)

- September 2024 (1)

- July 2023 (1)

- June 2023 (1)

- June 2022 (1)

- March 2022 (2)

- February 2022 (2)

- January 2022 (2)

- September 2021 (1)

- August 2021 (5)

- July 2021 (2)

- June 2021 (2)

- May 2021 (2)

- March 2021 (2)

- February 2021 (2)

- January 2021 (2)

- December 2020 (2)

- November 2020 (1)

- October 2020 (3)

- September 2020 (2)

- August 2020 (2)

- July 2020 (2)

- June 2020 (1)

- May 2020 (2)

- April 2020 (3)

- March 2020 (2)

- February 2020 (2)

- January 2020 (5)

- December 2019 (3)

- November 2019 (3)

- October 2019 (1)

- September 2019 (4)

- August 2019 (4)

- July 2019 (7)

- June 2019 (4)

- April 2019 (3)

- March 2019 (3)

- February 2019 (1)

- June 2010 (1)

Subscribe by email

Share this

Previous story

← What Insurance Does A Mobile Mechanic Need?You May Also Like

These Related Stories

What To Do If Your House Is Subsiding

What To Do If Your House Is Subsiding

Sep 4, 2019 12:00:00 AM

2

min read

Does Home Insurance Cover Subsidence?

Does Home Insurance Cover Subsidence?

Aug 31, 2021 10:00:00 AM

2

min read

How To Check A Property For Subsidence

How To Check A Property For Subsidence

Apr 10, 2025 12:34:30 PM

2

min read

No Comments Yet

Let us know what you think