Understanding Home Insurance Subsidence Cover: Essential For Older Properties

By Crowthorne Insurance on Jan 27, 2026 10:00:01 AM

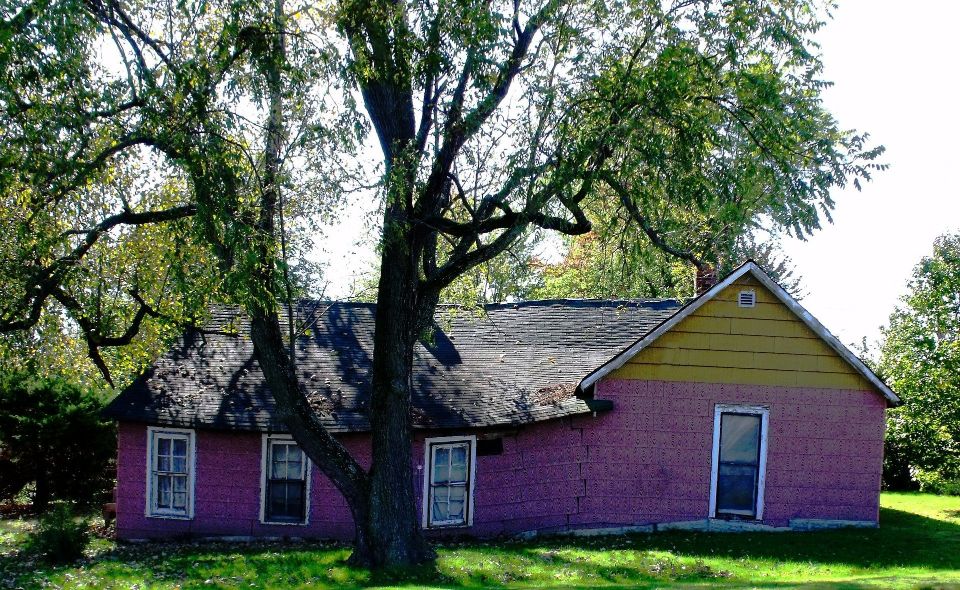

Older homes often have character, charm, and a sense of identity that newer properties may lack. However, their age also makes them vulnerable to greater structural risk.

One of the most significant of these is subsidence. As buildings get older, foundations and materials can weaken, making movement in the ground more likely to cause damage. That’s why having the right home insurance subsidence cover is especially important for owners of older properties.

Why Older Properties Are More Susceptible To Subsidence

Subsidence occurs when the ground beneath a property sinks or shifts, causing the foundations to move. In older homes, traditional building methods and materials such as shallow foundations, clay bricks, and lime mortar make them more vulnerable to these changes, as many older construction materials behave differently over time compared to modern alternatives

Over time, factors like tree roots, leaking drains, or prolonged dry weather can further destabilise the ground. As a result, many older homes develop cracks in walls or floors, sticking doors, and other tell-tale signs of movement.

According to property experts, homes built before the 1950s are particularly prone to minor structural shifts, and while not all movement is serious, insurers may still need evidence that any historic movement has been investigated and resolved.

What Home Insurance Cover For Subsidence Typically Includes

Most standard home insurance policies include subsidence cover, but only for properties with no unresolved or ongoing history of subsidence.

This section of the policy is designed to help with the cost of repairing damage caused by subsidence, ground heave, or landslip. It usually covers:

- Repairs to the main structure of the home, such as foundations and walls

- Rebuilding work following stabilisation or underpinning

- Professional fees for surveyors or engineers involved in the repair process

However, some policies exclude damage to outdoor structures such as fences, patios, or driveways. Insurers also apply a higher excess for home insurance covering subsidence, which can be upwards of £1,000 depending on the provider.

Declaring Property Details And Age

When applying for home insurance cover for subsidence, it’s essential to give full and accurate details about your property, including its age, construction type, and any previous movement or repairs. Non-disclosure of known issues could invalidate your policy or lead to a claim being declined.

Older properties that have been underpinned or have a history of movement are not automatically uninsurable, but insurers will need evidence that historical subsidence has been properly resolved and that the building remains stable.

Providing a structural engineer’s report or survey can strengthen your application and give insurers confidence that the risk is understood and managed.

Preventative Measures To Reduce Subsidence Risk

Of course, you can’t change a property’s age. You can, however, take steps to lower the likelihood of future movement:

- Keep trees and shrubs pruned to prevent root interference near foundations

- Maintain gutters and drains to avoid leaks that soften the ground

- Monitor cracks and structural movement with regular inspections

- Ensure good ventilation and moisture control to protect older materials

These simple measures can help reduce the risk of subsidence and demonstrate responsible property maintenance to insurers.

Protect Your Older Property With Crowthorne

Owning a period or heritage home is a privilege that also brings added responsibility. Having the right home insurance subsidence cover keeps your property, and your investment, protected against one of the most common and costly structural issues.

At Crowthorne Insurance, we help homeowners secure reliable, tailored cover for properties of all ages, including those with subsidence risks. As proud members of the British Insurance Brokers’ Association (BIBA), we work with trusted UK insurers who understand the complexities of older homes. Protect your property’s future, contact Crowthorne today for expert advice and a personalised quote on home insurance covering subsidence.

Image source: Canva

- Home Insurance (29)

- Non-Standard Homes (17)

- Motor Trade Insurance (15)

- Car Insurance (12)

- Subsidence (9)

- Bad Credit History (2)

- Business Insurance (2)

- Insurance Broker UK (2)

- Motor Trade Policy (2)

- Motorcycle Insurance (2)

- Public Liability Insurance (2)

- Travel Insurance (2)

- Additional Business Use (1)

- Car Accident (1)

- Case Study (1)

- Holiday Home Insurance (1)

- Motor Insurance Database (1)

- Service Indemnity Insurance (1)

- Timber Frame House (1)

- January 2026 (6)

- December 2025 (7)

- November 2025 (4)

- October 2025 (4)

- September 2025 (3)

- August 2025 (1)

- April 2025 (1)

- March 2025 (1)

- November 2024 (1)

- October 2024 (2)

- September 2024 (1)

- July 2023 (1)

- June 2023 (1)

- June 2022 (1)

- March 2022 (2)

- February 2022 (2)

- January 2022 (2)

- September 2021 (1)

- August 2021 (5)

- July 2021 (2)

- June 2021 (2)

- May 2021 (2)

- March 2021 (2)

- February 2021 (2)

- January 2021 (2)

- December 2020 (2)

- November 2020 (1)

- October 2020 (3)

- September 2020 (2)

- August 2020 (2)

- July 2020 (2)

- June 2020 (1)

- May 2020 (2)

- April 2020 (3)

- March 2020 (2)

- February 2020 (2)

- January 2020 (5)

- December 2019 (3)

- November 2019 (3)

- October 2019 (1)

- September 2019 (4)

- August 2019 (4)

- July 2019 (7)

- June 2019 (4)

- April 2019 (3)

- March 2019 (3)

- February 2019 (1)

- June 2010 (1)

Subscribe by email

You May Also Like

These Related Stories

Does Home Insurance Cover Subsidence?

What Are The 5 Biggest Causes Of Subsidence?

No Comments Yet

Let us know what you think