What Is Subsidence and Landslip Cover?

By Crowthorne Insurance on Aug 19, 2021 10:00:00 AM

When buying home insurance most people concentrate on risks such as theft, fire, and extreme weather conditions, but you may also want to include subsidence and landslip. Here are a few things you need to know about home insurance subsidence cover.

What Is Subsidence?

Subsidence is when the ground beneath a property gradually sinks, pulling your property’s foundation down with it. This imbalance puts stress on the structure of your house, causing cracks on the walls and floors. It could also potentially destabilise the construction of your property. Subsidence is caused by a range of things such as:

• Clay shrinkage

• Water washing away soil beneath the property

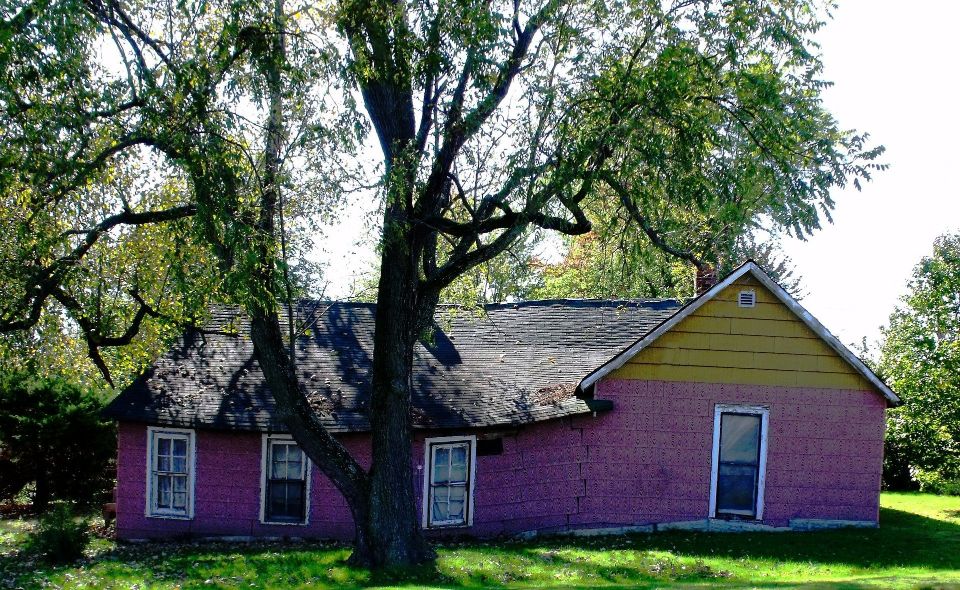

• Trees growing close to the foundation

• Formation of underground caverns

• Used and disused mines

• Poor foundations

What Is A landslip?

Landslip is the sudden sliding of a large mass of soil or rocks down the side of a cliff or mountain. It is caused by disturbances in the natural stability of a slope.

What Is Subsidence and Landslip Cover?

If you suspect that your property is at the risk of subsidence or a landslip, it is crucial that you take an insurance policy out as soon as possible. If the damage is minimal and the movement of your property has stopped, repairs can be done straight away. However, if the damage is extensive, your property will have to be monitored for a while before a solution is found. During this period, you may be required to evacuate your tenants, which means that you risk losing rental income. Having the right buildings insurance subsidence cover will come in handy during this challenging time, so check your policy to ensure that your building has adequate insurance protection. Most home insurance policies provide minimal cover, if any, for subsidence and landslip unless you specifically ask for house insurance subsidence cover. Here are two types of insurance that cover subsidence and landslip.

1. Buildings

This policy protects your property in case it is damaged and has to be repaired or rebuilt. It covers damage caused by fire, vandalism, subsidence, and weather events such as storms, floods, etc. When buying this policy, ensure that it comes with inflation protection. This feature provides an increase in the value of benefits due to the rise of inflation over time.

2. Accidental damage

Landlord accidental damage cover protects you against the cost of damages caused by an insured event such as storms, landslips, subsidence, vandalism, etc. It covers household items such as appliances and soft furnishings provided to your tenants.

To protect yourself against landslip and subsidence, contact us today to explore your insurance policy options.

- Home Insurance (30)

- Non-Standard Homes (17)

- Motor Trade Insurance (16)

- Car Insurance (12)

- Subsidence (10)

- Bad Credit History (2)

- Business Insurance (2)

- Insurance Broker UK (2)

- Motor Trade Policy (2)

- Motorcycle Insurance (2)

- Public Liability Insurance (2)

- Travel Insurance (2)

- Additional Business Use (1)

- Car Accident (1)

- Case Study (1)

- Holiday Home Insurance (1)

- Motor Insurance Database (1)

- Service Indemnity Insurance (1)

- Timber Frame House (1)

- January 2026 (8)

- December 2025 (7)

- November 2025 (4)

- October 2025 (4)

- September 2025 (3)

- August 2025 (1)

- April 2025 (1)

- March 2025 (1)

- November 2024 (1)

- October 2024 (2)

- September 2024 (1)

- July 2023 (1)

- June 2023 (1)

- June 2022 (1)

- March 2022 (2)

- February 2022 (2)

- January 2022 (2)

- September 2021 (1)

- August 2021 (5)

- July 2021 (2)

- June 2021 (2)

- May 2021 (2)

- March 2021 (2)

- February 2021 (2)

- January 2021 (2)

- December 2020 (2)

- November 2020 (1)

- October 2020 (3)

- September 2020 (2)

- August 2020 (2)

- July 2020 (2)

- June 2020 (1)

- May 2020 (2)

- April 2020 (3)

- March 2020 (2)

- February 2020 (2)

- January 2020 (5)

- December 2019 (3)

- November 2019 (3)

- October 2019 (1)

- September 2019 (4)

- August 2019 (4)

- July 2019 (7)

- June 2019 (4)

- April 2019 (3)

- March 2019 (3)

- February 2019 (1)

- June 2010 (1)

Subscribe by email

You May Also Like

These Related Stories

Does Home Insurance Cover Subsidence?

Understanding Home Insurance Subsidence Cover: Essential For Older Properties

No Comments Yet

Let us know what you think