Crowthorne Insurance: What Not To Do Immediately After A Car Accident

By Crowthorne Insurance on Jul 10, 2019 12:00:00 AM

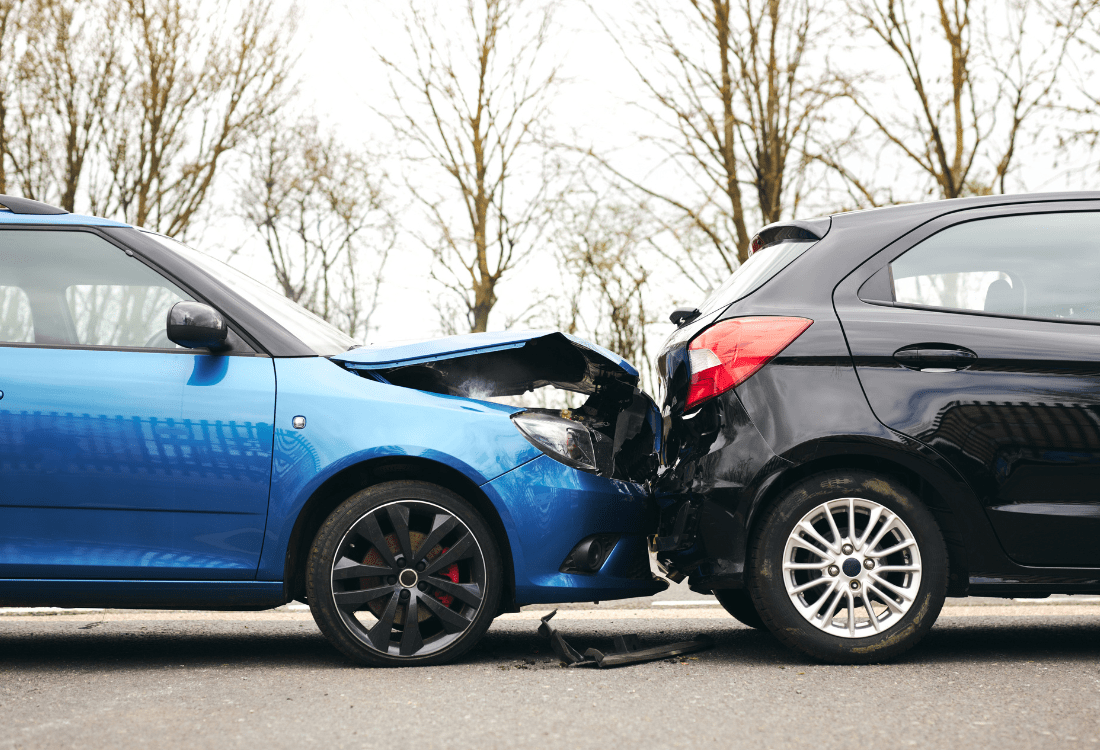

As anyone that has been in a car accident can attest, the experience is often stressful and very upsetting. Indeed, it is all too easy to panic and act on impulse – but instincts may compromise your ability to make claims for any damages.

If you experience a car accident and are wondering what to do, particularly if you’re thinking “it’s not my fault!”, there are a few small steps you can take to protect yourself from financial losses and potentially lengthy legal battles. Here are some tips regarding what not to do after a car accident:

1. Do Not Leave The Scene

The number one rule regarding what to do in a car accident is to stay on the scene. If your collision is fairly minor and no-one appears to be injured, it may be tempting to drive away and deal with the legal issues later. Unfortunately, this could put you on the wrong side of the law.

Do not forget to collect contact details of any witnesses and take photos of the accident scene including the road layout, both vehicles, the damage caused and, if possible, a picture showing how many people were in the other vehicle.

As soon as the accident occurs, it is important that you safely get out of your vehicle, double check that the other driver involved is unharmed, swap insurance information and report the accident to your Insurer or Broker.

2. Do Not Get Angry

Whilst car accidents can be highly distressing, staying calm is very important if you want to deal with the aftermath effectively. Do not start by directing blame towards the other driver, as they are likely to be in as much shock and distress as you. Anger and pointing fingers will not make the situation any better. Being polite, considered and empathetic will put you in good stead to examine the situation in a calm and collected manner. Do not admit any liability to the other driver

3. In A Serious Accident, Contact The Police

If either party is seriously injured or the accident has caused significant public disruption, such as road blocking, call the police. A police report can also be useful for your Insurers.

Find Out More With Crowthorne Insurance

If you want to find out more about car insurance and the kinds of policies that could work for you, do not hesitate to get in touch.

- Home Insurance (30)

- Motor Trade Insurance (17)

- Non-Standard Homes (17)

- Car Insurance (12)

- Subsidence (10)

- Bad Credit History (2)

- Business Insurance (2)

- Insurance Broker UK (2)

- Motor Trade Policy (2)

- Motorcycle Insurance (2)

- Public Liability Insurance (2)

- Travel Insurance (2)

- Additional Business Use (1)

- Car Accident (1)

- Case Study (1)

- Holiday Home Insurance (1)

- Motor Insurance Database (1)

- Service Indemnity Insurance (1)

- Timber Frame House (1)

- February 2026 (1)

- January 2026 (8)

- December 2025 (7)

- November 2025 (4)

- October 2025 (4)

- September 2025 (3)

- August 2025 (1)

- April 2025 (1)

- March 2025 (1)

- November 2024 (1)

- October 2024 (2)

- September 2024 (1)

- July 2023 (1)

- June 2023 (1)

- June 2022 (1)

- March 2022 (2)

- February 2022 (2)

- January 2022 (2)

- September 2021 (1)

- August 2021 (5)

- July 2021 (2)

- June 2021 (2)

- May 2021 (2)

- March 2021 (2)

- February 2021 (2)

- January 2021 (2)

- December 2020 (2)

- November 2020 (1)

- October 2020 (3)

- September 2020 (2)

- August 2020 (2)

- July 2020 (2)

- June 2020 (1)

- May 2020 (2)

- April 2020 (3)

- March 2020 (2)

- February 2020 (2)

- January 2020 (5)

- December 2019 (3)

- November 2019 (3)

- October 2019 (1)

- September 2019 (4)

- August 2019 (4)

- July 2019 (7)

- June 2019 (4)

- April 2019 (3)

- March 2019 (3)

- February 2019 (1)

- June 2010 (1)

Subscribe by email

You May Also Like

These Related Stories

Did You Know That If You Are Having Renovations Or Improvements Carried Out On Your Home Without Telling Your Insurer It May Invalidate Your Policy?

How To Insure A Car Imported From Outside The UK

No Comments Yet

Let us know what you think