What To Consider Before Utilising The Rent-A-Room Relief Scheme

By Crowthorne Insurance on Feb 3, 2022 11:15:00 AM

Many people decide to take in a lodger to fill a spare room, gain some extra income, and have a little more company around the house. The rent a room relief scheme has come as a welcome change for those looking to rent out their spare rooms to lodgers. But not just anyone can utilise …

What Kind Of Insurance Do Lodgers Need?

By Crowthorne Insurance on Jan 27, 2022 10:30:00 AM

As a lodger, you will enjoy a comfortable and fully furnished room in a warm and friendly home for a reasonable cost. More and more people, especially young professionals, are taking advantage of becoming lodgers as a way to save money and live in a peaceful environment. However, you …

Does Home Insurance Cover Lodgers?

By Crowthorne Insurance on Jan 20, 2022 10:15:00 AM

Taking in a lodger can be an excellent way to make some extra money, fill an empty room, and have some company around the home. With more and more people renting out their spare rooms to lodgers, the question comes up time and time again – do you need home insurance to include lodgers …

Get An Insurance Quote With VIN Number From Crowthorne Insurance Today!

By Crowthorne Insurance on Sep 15, 2021 10:30:00 AM

Getting chassis car insurance might not be something you even realised you could need to do, but in certain circumstances, it can be essential. When getting chassis insurance UK drivers trust Crowthorne Insurance, because of our industry experience and our affordable chassis insurance …

Does Home Insurance Cover Subsidence?

By Crowthorne Insurance on Aug 31, 2021 10:00:00 AM

Should your home suffer from subsidence, you might find that you run into some issues with making a claim on your insurance. Here, we will explain what subsidence is, what the causes of subsidence are, when you can make a claim, and we’ll answer the question, “is subsidence covered by …

What To Think About When Renting Out A Spare Room?

By Crowthorne Insurance on Aug 27, 2021 10:30:00 AM

If you have a spare room in your home, you may be wondering what to do with that empty space. Finding out you can make some extra money and have someone around the house might seem tempting – in which case you could think about getting a lodger. But before you do, you should consider …

Signs Of Subsidence: What To Look Out For

By Crowthorne Insurance on Aug 24, 2021 11:30:00 AM

Subsidence is one of the most serious and incredibly damaging issues that your home can encounter. If left unattended, subsidence can cause significant problems for your house, resulting in structural damage that could leave you with a hefty bill. But it can be all too easy to let the …

What Is Subsidence and Landslip Cover?

By Crowthorne Insurance on Aug 19, 2021 10:00:00 AM

When buying home insurance most people concentrate on risks such as theft, fire, and extreme weather conditions, but you may also want to include subsidence and landslip. Here are a few things you need to know about home insurance subsidence cover.

Why Should You Get Shop Insurance For Your Bike Stock?

By Crowthorne Insurance on Aug 11, 2021 11:00:00 AM

Cycle shop insurance is a necessary consideration for many bike shop owners. With a large capital investment represented in the stock displayed on-premises, you need to know that stock is properly covered. Shop insurance is a broad collection of policies, however, and you may need mor …

What Is The Best Motor Trade Insurance?

By Crowthorne Insurance on Jul 14, 2021 10:30:00 AM

Motor trade insurance is insurance cover specifically for those in the motor trade business. This could be trading vehicles, repairing vehicles, or as a breakdown recovery agent. It’s essential in order for you to trade and sell cars and covers the vehicles that are owned or being tra …

- Home Insurance (30)

- Motor Trade Insurance (17)

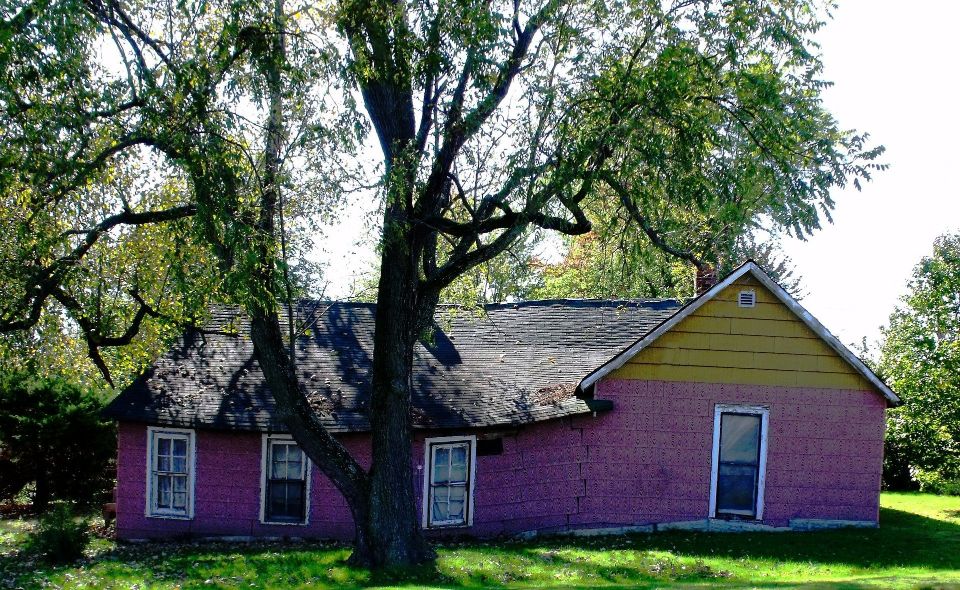

- Non-Standard Homes (17)

- Car Insurance (12)

- Subsidence (10)

- Bad Credit History (2)

- Business Insurance (2)

- Insurance Broker UK (2)

- Motor Trade Policy (2)

- Motorcycle Insurance (2)

- Public Liability Insurance (2)

- Travel Insurance (2)

- Additional Business Use (1)

- Car Accident (1)

- Case Study (1)

- Holiday Home Insurance (1)

- Motor Insurance Database (1)

- Service Indemnity Insurance (1)

- Timber Frame House (1)

- February 2026 (1)

- January 2026 (8)

- December 2025 (7)

- November 2025 (4)

- October 2025 (4)

- September 2025 (3)

- August 2025 (1)

- April 2025 (1)

- March 2025 (1)

- November 2024 (1)

- October 2024 (2)

- September 2024 (1)

- July 2023 (1)

- June 2023 (1)

- June 2022 (1)

- March 2022 (2)

- February 2022 (2)

- January 2022 (2)

- September 2021 (1)

- August 2021 (5)

- July 2021 (2)

- June 2021 (2)

- May 2021 (2)

- March 2021 (2)

- February 2021 (2)

- January 2021 (2)

- December 2020 (2)

- November 2020 (1)

- October 2020 (3)

- September 2020 (2)

- August 2020 (2)

- July 2020 (2)

- June 2020 (1)

- May 2020 (2)

- April 2020 (3)

- March 2020 (2)

- February 2020 (2)

- January 2020 (5)

- December 2019 (3)

- November 2019 (3)

- October 2019 (1)

- September 2019 (4)

- August 2019 (4)

- July 2019 (7)

- June 2019 (4)

- April 2019 (3)

- March 2019 (3)

- February 2019 (1)

- June 2010 (1)